As you probably know, (especially if you’re a reader of the Tax Reduction Letter!), the Tax Cuts and Jobs Act created a 20-percent tax deduction for many business owners.

Do you qualify for this extremely valuable deduction? The answer depends on a number of factors that you’ll need to calculate.

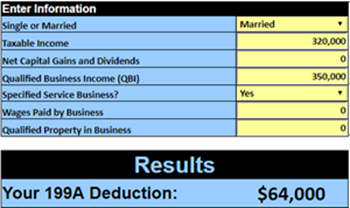

Yes. You can make these complex calculations by hand or with tax preparation software. But why, when you can use our new 2019 Section 199A Calculator absolutely free?

Want to make tough calculations easy and save time, money, and headaches?

Read my new article titled…

A Powerful FREE tool for Your Use:

Our New 2019 Section 199A Calculator.

Here’s just some of what you’ll learn

when you read my new article.

- Which business-types easily qualify for the 20-percent deduction

- How our free calculator can help you deal with capital gains and dividends and much more

- The easy way to handle wages and property calculations

- What the tax code means by “phase-in limits.” (You really need to understand this term!)

- Why it’s so important to start tax planning now if you want to get your 20-percent deduction

- And much more!