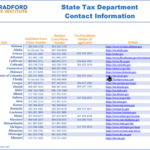

“Your Essential State TaxContact Guide for 2025” To get my complete articlewith all the details… As 2025 begins, staying organized and informed is key to simplifying your tax season. That’s why we’ve created the 2025 State Tax Department Contact Information PDF—a must-have resource for tax professionals, business owners, and individuals alike. Here’s what makes … [Read more...]

New IRS Rules for Inherited IRAs in 2025—What You Need to Know

“Don’t Let IRS Rule ChangesCatch You Off Guard” To get my complete articlewith all the details… Big changes are coming for inherited IRAs in 2025, and understanding these updates is critical to protecting your retirement savings. Key highlights: Required Minimum Distributions (RMDs) are now mandatory for most beneficiaries. Missing them could cost you up to 25% … [Read more...]

Your Business Tax Breaks Could Vanish Soon—What’s at Risk?

“Game On: TCJA Winners and Losers— Business on the Chopping Block” To get my complete articlewith all the details… Warning: The tax landscape is about to shift dramatically. The TCJA provisions expiring in 2025 could substantially increase your tax burden overnight. Are you prepared for: Your qualified business income deduction (worth up to 20% of your profits) … [Read more...]

URGENT: Dec. 31 Deadline – Deduct Prepaid 2025 Rent Paid by Your Corporation to You

“Surprise: Related Party RulesDo Not Kill Prepaid Rent Strategy” To get my complete articlewith all the details… Time-Sensitive Tax Alert: Only weeks remain to implement this powerful tax strategy before December 31, 2024! You need this on your calendar. Just Discovered: A game-changing interpretation that allows your corporation to deduct prepaid rent it pays … [Read more...]

Critical Year-End Tax Strategies for Your Crypto Gains (2024)

“2024 Year-End Tax Strategiesfor Crypto Investors” To get my complete articlewith all the details… If you've profited from Bitcoin's record-breaking year, you might be sitting on significant gains – and potentially hefty taxes. But there's still time to optimize your 2024 tax position before December 31st. We've just published a comprehensive guide outlining 5 … [Read more...]