All Sole Proprietors!

All Sole Proprietors!

Act now and get your FREE

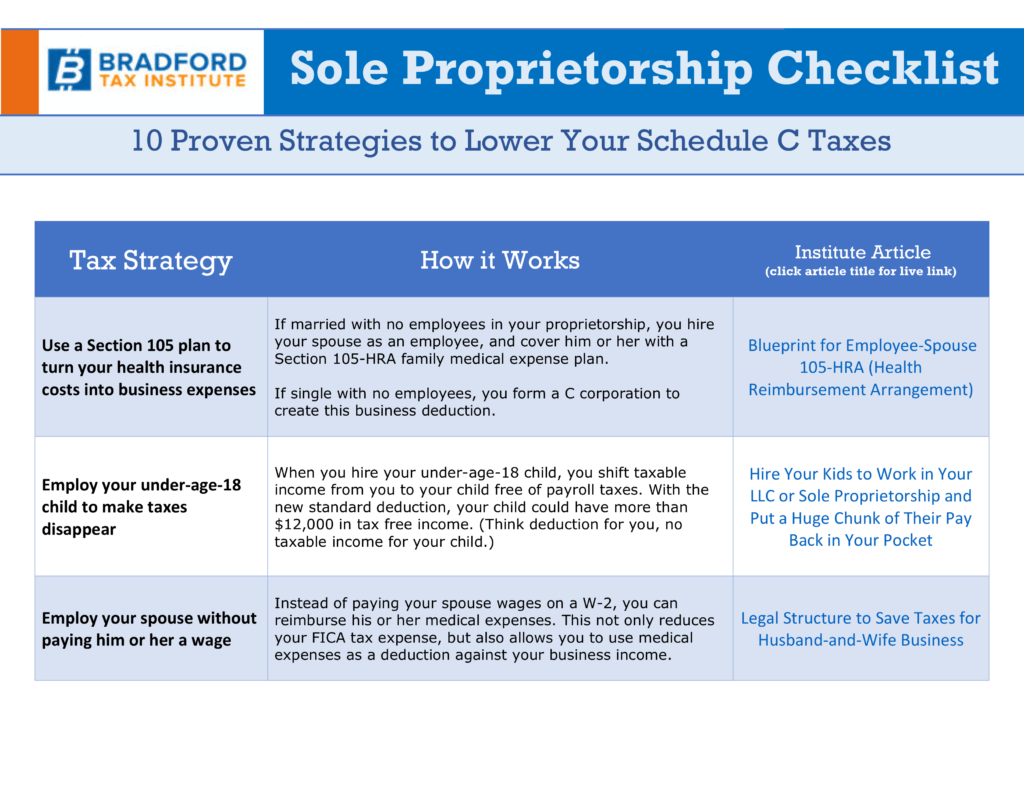

“Sole Proprietor Checklist”

Get 10 proven strategies

for slashing your Schedule C taxes!

(No risk. No obligation. No charge.)

Dear Sole Proprietor:

Careful! You may be overpaying thousands of dollars in taxes!

That’s right. Unless you know how to take advantage of the U.S. tax code, you may be paying the IRS a lot of money that actually belongs in your pocket.

Well, the Bradford Tax Institute has done something about it.

We’ve prepared an easy-to-understand free checklist that explains ten, totally legal strategies designed to slash your Schedule C taxes.

Here are just some of the winning strategies

we’ve got waiting for you…

- How to make your health insurance a tax-favored business deduction!

- How employing your under-age-18 child can make taxable income vanish!

- How to hire your spouse without paying a W-2 wage!

- How to dramatically increase your vehicle deductions!

- When the tax code authorizes you to give yourself flowers, fruit, and books as tax-deductible fringe benefits!

- How to use the seven-day tax-deduction travel rule to create a business trip that’s 87% personal vacation!

- And that’s just for starters!

Sure you can waste thousands of dollars overpaying the IRS. But why? It makes much more sense to…