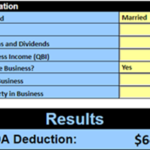

As you probably know, (especially if you’re a reader of the Tax Reduction Letter!), the Tax Cuts and Jobs Act created a 20-percent tax deduction for many business owners. Do you qualify for this extremely valuable deduction? The answer depends on a number of factors that you’ll need to calculate. Yes. You can make these complex calculations by hand or with tax preparation … [Read more...]

Tax Policy

Sorted by Date

Q&A: Do I Get a 199A Deduction Working Abroad?

Do you live and work abroad? If you do, you’ll want to know if your business-income qualifies for the new 20-percent Section 199A tax deduction. Sadly, we don’t have great news for you. However, if you play your cards right, and review the strategies explained in this article, it’s very possible that you won’t owe much tax to Uncle Sam. What issues will you have to … [Read more...]

Q&A: Claim 30% Tax Credit for a New Roof to Hold Solar Panels

Thinking about putting some solar panels on your roof? It makes a lot of sense. Harnessing the power of the sun to create electricity is good for the environment, good for your electricity bill, and good for your wallet. You see, you are eligible for a generous 30-percent residential tax credit when you install solar equipment on your residence. Want to learn more … [Read more...]

Proprietors and Partners Mistakenly Pay Themselves Illegal W-2 Wages

Sole proprietors and partners often suffer from W-2 envy. And I know why. If they’re earning more than the Section 199A pay limits, they look to W-2 wages as a way to salvage the juicy 20-percent deduction allowed by Section 199A. In fact, some sole proprietors and partners often have their Certified Professional Organizations (CPEO) pay them on a W-2. This is wrong. … [Read more...]

Free checklist: 10 proven tax-reduction strategies for sole proprietors

All Sole Proprietors! Act now and get your FREE “Sole Proprietor Checklist” Get 10 proven strategiesfor slashing your Schedule C taxes! (No risk. No obligation. No charge.) Dear Sole Proprietor: Careful! You may be overpaying thousands of dollars in taxes! That’s right. Unless you know how to take advantage of the U.S. tax code, you may be paying the IRS a lot … [Read more...]