“Can Real Estate Professional StatusFree Up Old Passive Losses?” To get my complete articlewith all the details… As tax season approaches, many real estate investors who've recently qualified as real estate professionals are asking a critical question: "Now that I'm a real estate professional, can I deduct all those passive losses from previous years?" The … [Read more...]

Tax Planning

Sorted by Date

Real Estate Dealer or Investor? The IRS’s View Matters

“Are You a Real Estate Dealeror Investor?” To get my complete articlewith all the details… "Am I a real estate dealer or investor?" It seems like a simple question, but the answer could dramatically impact your tax situation. We've just published a comprehensive guide that: Clarifies how the IRS views each classification Explains the tax implications for … [Read more...]

Missed an Estimated Tax Payment? Here’s What to Do Next

“Don't Let PenaltiesCatch You Off Guard” To get my complete articlewith all the details… Missing an estimated tax payment can lead to non-deductible penalties that add up quickly. But you have options to mitigate the impact—and even avoid penalties in the future. Our latest article, "Missed an Estimated Tax Payment—Now What?", breaks down: Steps to take … [Read more...]

Do You Need to Report Your Home Sale to the IRS?

“Don't Let a Simple OversightLead to IRS Complications” To get my complete articlewith all the details… Selling your home can be an exciting milestone, but it also comes with important tax considerations. Did you know: If your home sale gains qualify for the $250,000/$500,000 exclusion, you might not need to report it. Even so, reporting when not required to … [Read more...]

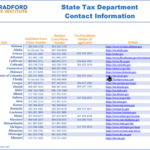

Stay Ahead in 2025: Download Your State Tax Contact Guide Now

“Your Essential State TaxContact Guide for 2025” To get my complete articlewith all the details… As 2025 begins, staying organized and informed is key to simplifying your tax season. That’s why we’ve created the 2025 State Tax Department Contact Information PDF—a must-have resource for tax professionals, business owners, and individuals alike. Here’s what makes … [Read more...]