Want to get an early start cutting your tax bill in 2020? Then my new article is for you! You see, if you’re running a proprietorship, partnership, or corporate business, you probably already know that a home office can offer a significant tax deduction. But what you may not know is that you can get a home-office deduction for your rental property as well as a deduction … [Read more...]

Rental Properties

Sorted by Date

Will the Newly Released Section 199A Rental Safe Harbor Work for You?

Back in January 2019, the IRS provided you with a Section 199A safe-harbor option for your rental properties. This was great news because the safe harbor made it a lot easier for your rental properties to qualify for the valuable 20% Section 199A deduction. Now, nine months later, the IRS has issued the final version of the rental safe harbor and it includes some very … [Read more...]

Converting Your Residence into a Rental Property: Tax Issues

As you probably know, residential real estate prices are way up in many parts of the country. Rental rates are also very high. That’s why you should consider buying a new residence and converting your current residence into a rental property. Why make this move? Because you can very possibly sell your rental property down the road for a much higher price! But … [Read more...]

Capture Your 199A Tax Deduction

Get your 94-page FREE eBook right now. (It normally sells for $129!) “A Practical Guideto the Section 199A Deduction” How to put the powerof this fabulous deduction to work for YOU! (Yours FREE as a “thank you” gift) Dear Business Owner in Search Of A Huge Deduction: I’m writing to tell you that you may be eligible for a deduction of up to 20% of … [Read more...]

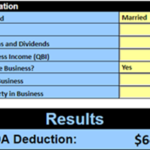

Use Our New 2019 Section 199A Calculator

As you probably know, (especially if you’re a reader of the Tax Reduction Letter!), the Tax Cuts and Jobs Act created a 20-percent tax deduction for many business owners. Do you qualify for this extremely valuable deduction? The answer depends on a number of factors that you’ll need to calculate. Yes. You can make these complex calculations by hand or with tax preparation … [Read more...]