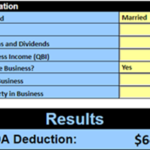

As you probably know, (especially if you’re a reader of the Tax Reduction Letter!), the Tax Cuts and Jobs Act created a 20-percent tax deduction for many business owners. Do you qualify for this extremely valuable deduction? The answer depends on a number of factors that you’ll need to calculate. Yes. You can make these complex calculations by hand or with tax preparation … [Read more...]

Legislation

Sorted by Date

Creating More Business-Meal Tax Deductions After the TCJA

Eat up! Thanks to changes in the Tax Cuts and Jobs Act (TCJA), it’s now much easier to write-off business meals for you, your customers, other business contacts — and even your spouse! That’s right. The IRS has reverted to the pre-1963 (more business-friendly) “ordinary” and “necessary” business-expense rules. So what are they? We’ll explain fully when you read my new … [Read more...]

When Renting to a C Corporation Creates QBI

There’s one section of the tax code that can save you a lot of money. I’m talking about Section 199A. It lets you claim a valuable 20-percent qualified-business-income (QBI) deduction when you rent an office or other building to your personally owned C corporation. But of course, since we’re dealing with the IRS, the devil is in the details. We’ll help you understand … [Read more...]

QBI and Self-Employment Tax Savings for S Corp. as a Partner

Here are three important questions for S corporation owners: Do you own 100-percent of your S corporation?Is your S corporation a partner in one or more partnerships and does it receive a combination of guaranteed payments and ordinary pass-through income from these partnerships?Do you draw a salary from the S corporation for the services you perform for those … [Read more...]

Free report: “Rental Property & The 199A Deduction”

Download your FREE REPORT right now… “Rental Property & The 199A Deduction” Don’t miss gettingyour Section 199A 20% tax deduction! This special 21-page report normally sells for $79.Now it’s yours FREE with no obligation! Dear Rental Property Owner: Whether you own just one rental property or many, don’t miss this information-packed free report from … [Read more...]