Yes. You deserve credit for making donations to your place of worship, school, or other 501(c)(3) charity. But you deserve even more credit if you know how to be charitable and take full advantage of the tax law. You see, if you make your donation as a business expense, you can help your favorite charity and get a valuable tax break for yourself! Want to find out how to … [Read more...]

Corporations

Sorted by Date

Know This About Employer-Issued Incentive Stock Options (ISOs)

Taking advantage of employer-issued incentive stock options (ISOs) can potentially put a lot of money in your pocket. But to come out a winner, you’ll have to make some important decisions. To make them wisely, you’ll need to understand the impact of both the regular federal income tax and the alternative minimum tax (AMT) on your ISOs. Want to find out more about this … [Read more...]

Does the Per Diem Expense Option Stick It to Business Owners?

If you run your own business and travel on business, the per diem option may look like a good deal. I get it. That’s because instead of keeping track of every dollar you spend on travel and lodging, you can deduct a fixed amount and call it a day. But be careful! There’s a business-owner per diem trap set for youthat you don’t want to fall into. What is it? How … [Read more...]

Divorce: Beat Alimony, Redeem Spouse’s Stock in Your Closely Held Corp.

If you’re getting a divorce, or are in the process of getting one, my new article makes must reading. Why? Because the Tax Cuts and Jobs Act of 2017 (TCJA) significantly changed the way you should handle divorce planning now. Failing to understand how to comply with Uncle Sam’s rules can cost you a lot of money. That’s why it’s so important for you to read my new article … [Read more...]

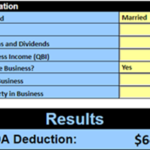

Use Our New 2019 Section 199A Calculator

As you probably know, (especially if you’re a reader of the Tax Reduction Letter!), the Tax Cuts and Jobs Act created a 20-percent tax deduction for many business owners. Do you qualify for this extremely valuable deduction? The answer depends on a number of factors that you’ll need to calculate. Yes. You can make these complex calculations by hand or with tax preparation … [Read more...]