Howdy partner! If you run your business as a partnership, or an LLC taxed as a partnership, there are some important things you need to know. For starters, you should be aware that Congress changed the IRS procedures for auditing partnerships. These new procedures take effect beginning with your 2018 partnership tax return. Under the new rules, an audit can lead to a … [Read more...]

Choice of entity

Sorted by Date

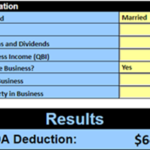

Use Our New 2019 Section 199A Calculator

As you probably know, (especially if you’re a reader of the Tax Reduction Letter!), the Tax Cuts and Jobs Act created a 20-percent tax deduction for many business owners. Do you qualify for this extremely valuable deduction? The answer depends on a number of factors that you’ll need to calculate. Yes. You can make these complex calculations by hand or with tax preparation … [Read more...]

How Corporations Reduce IRS Audits of Home-Office Deductions

Are you paranoid that your home-office deduction will invite an IRS audit? Well, you are not alone. Countless taxpayers fail to take advantage of a big deduction that they’re entitled to because they’re afraid of Uncle Sam. The fact of the matter is… We don’t consider the home-office deduction to be an audit flag. To get the whole story about a proven step you can … [Read more...]

Pay Zero Capital Gains Taxes on Sale of Small C Corporation!

Consider this… Let’s say you sell your business and the sale produces a $5-million capital gain. How much federal tax will you need to pay? The surprising answer is … zero! … not a penny. How can you get this terrific deal? Here’s the answer … operate your business as a tax-code-defined “qualified small business corporation” (QSBC). More good news. The Tax Cuts and Jobs … [Read more...]

When Renting to a C Corporation Creates QBI

There’s one section of the tax code that can save you a lot of money. I’m talking about Section 199A. It lets you claim a valuable 20-percent qualified-business-income (QBI) deduction when you rent an office or other building to your personally owned C corporation. But of course, since we’re dealing with the IRS, the devil is in the details. We’ll help you understand … [Read more...]